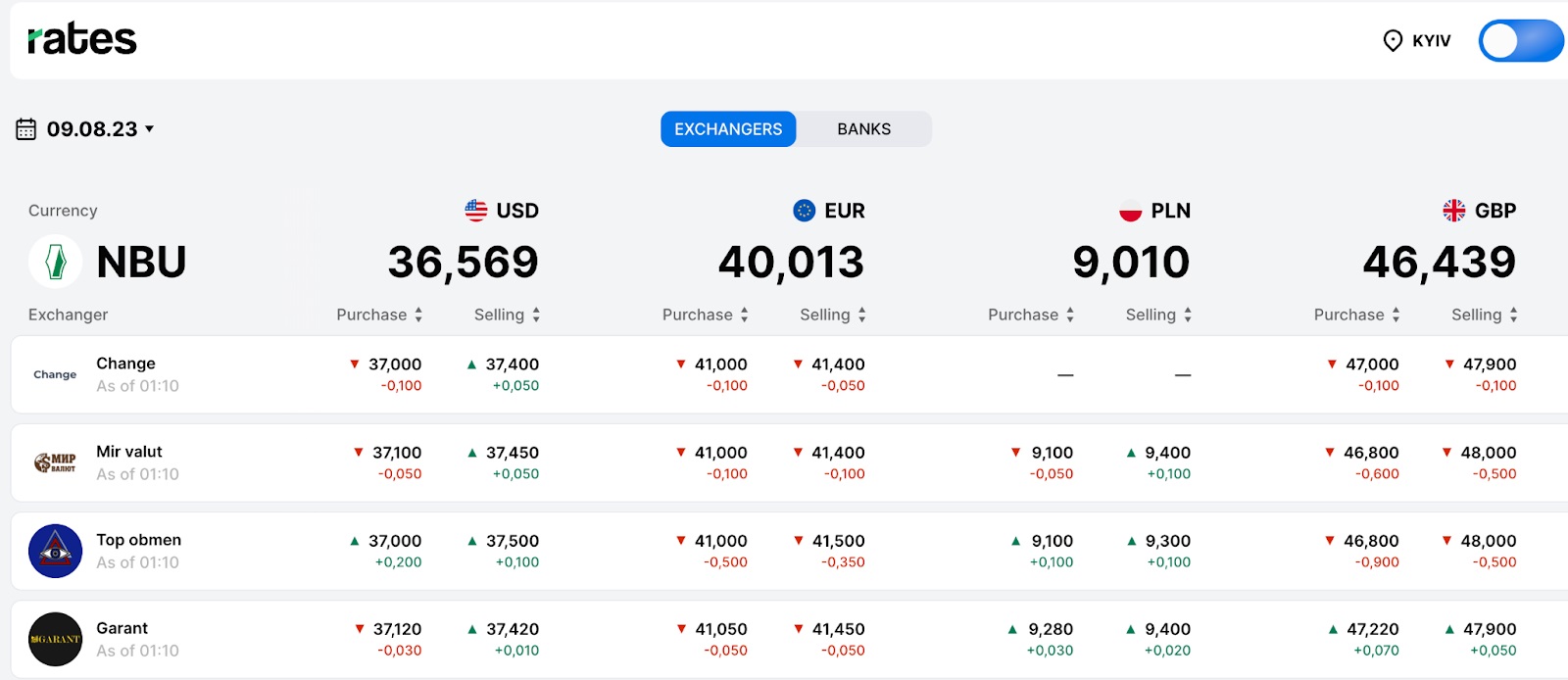

Ordinary users, entrepreneurs and companies that somehow interact with the market are trying to find the most convenient, most profitable, most reliable payment service. And often PayPal becomes the most convenient for many. However, this service also has certain limitations. In this article you will learn about worthy analogues of PayPal, you can also track the current exchange rates in Ukrainian financial institutions using the service https://rates.fm/.

What Is PayPal

PayPal is widely known and has a huge user base of around 435 million people as of 2023. The service provides payment security and works with many popular freelance exchanges, online marketplaces and a large number of local banks around the world.

- Payoneer

- Wise

- Xoom

- Skrill

- Stripes

- 2Checkout

- Bitcoin

But everything in this world has its drawbacks, and the service also has them. PayPal functionality is limited in a number of countries and works only for replenishing the balance and paying for goods in online stores. Also, users note the excessive suspicion of the service algorithms, due to which transactions can be blocked, and the support service is reluctant and takes a long time to resolve such situations.

For whatever reason you are looking for an alternative to PayPal, you will find it. Let’s look at some of them.

Payoneer

Today Payoneer is one of the most famous payment systems and one of the best analogues of PayPal. The payment system is available all over the world, its functionality is not limited anywhere, and the services offered are aimed at helping in the conduct and development of any business, which is why Payoneer is so popular among freelancers and users from developing countries.

Payoneer has a convenient payment request feature that allows you to instantly send a payment request even to unregistered users. The request is sent by e-mail and contains a link to the payment, according to which the employer or customer pays the salary directly from their bank account. A commission of up to 3% of the amount is paid either by the customer or the contractor. Payoneer sends payment reminders to those who try to ignore the request, a useful service for freelancers to help them get paid on time.

Payoneer also works as an electronic wallet: each user has a virtual account in the system, which receives payments from customers, money from freelance platforms and marketplaces. Funds can be withdrawn to a local bank account. Users can also issue a Payoneer card that can be used to pay in physical and online stores. With this card, you can withdraw money from your Payoneer balance at ATMs or bank cash desks.

The disadvantage of the system is high commissions and a fee of $30 per year for using a Payoneer plastic card (you don’t have to order a card, but it’s more convenient with it). This service is used by clients of such large companies as Coinbase, Aflac, Bank of America, and others.

Wise

Wise, formerly known as TransferWise, is known for its low fees. If most banks, payment systems and exchange platforms can take up to 5% of the amount in the form of hidden fees when transferring money abroad, then transferring money on popular currency routes with Wise becomes 8 times cheaper. You can save 5-10% of your funds if you choose Wise over other payment methods.

Freelancers who use the platform to receive payment can register and send their client a payment request with their bank details. The customer will pay for the request with their credit card. Working with Wise is beneficial for both parties: the sender of the payment pays a very small commission, which depends on the country and currency, but usually does not exceed 1% of the amount, and the recipient quickly receives money to his bank account, even if he is not registered in the system.

To receive funds, the user does not need to register, but he needs to register to send payments. That is, when working with a customer, you can give him your bank account details in any way, and he will pay for the work through Wise, but if you are the customer, then you will need an account.

The only drawback of the system is that it is still new and supports a small number of countries. There are 70 in total. Wise works well in Europe, but is only partially available in the US.

Skrill

The advantage of Skrill is the ability to make free transactions. The service charges a one-time commission when withdrawing money from the system balance to a bank account, it depends on the user’s country. You can find out about the amount of commission for a specific country on the Skrill website.

The disadvantage of the system is the restriction on working with large amounts (about $ 2000) without verification. The platform does not allow you to transfer a large amount, receive or withdraw it until the user passes the verification by providing a screen of an identity document, passport or bank statement.

There are also prejudices towards this service because of its work with online casinos and other gambling resources. This site should be chosen if, for some reason, Wise or Payoneer did not come up to you.

2Checkout

2Checkout is a payment system very similar to Stripe. It also cannot create a payment request, and it does not support direct payment transactions, so when working with 2Checkout, you will additionally have to use third-party software to create requests.

A big advantage of working with 2Checkout, in addition to processing credit card payments, is the ability to accept payments from PayPal even if you don’t have a PayPal account. Funds are stored on the system account, and they can be withdrawn to a bank account immediately after accumulating $300 on the balance.

Wrapping It Up

Among the most worthy analogues of the PayPal system are Payoneer and Wise. They have wide functionality, low commissions and fast transfer speeds. You can improve your experience of using international payment systems with the help of the currency exchange rate tracking service in Ukrainian financial institutions Rates. The service is available around the clock from any US city, in particular from the financial center of New York, as well as Los Angeles (California).