It may be worthwhile to purchase travel insurance if you are spending hundreds or thousands of dollars on a vacation. Travel insurance covers your trip investment in the event that you have to cancel or shorten your vacation due to a variety of factors such as weather, illness, government shutdowns, and more. Many plans also cover lost luggage or medical treatments incurred while traveling.

The best travel insurance packages are reasonably priced while still providing comprehensive coverage. They should have a low number of exclusions and limits, as well as a high level of client satisfaction. You should also conduct research to ensure that the policy covers your specific trip.

Top 8 Best Travel Insurance 2024 are listed below:

What Is Travel Insurance?

Travel insurance is a sort of insurance that covers common issues that arise when traveling. They can help protect the money you put down for your travel experience, from trip disruptions to full cancellations. Common coverage extends beyond an unexpected trip halt. Among other things, it can cover lost or damaged luggage and modifications to your itinerary for covered causes.

Medical coverage is vital to consider because your current health insurance may not cover you away from home. Medical treatment, dental emergency, and medical transportation are all covered by the best travel insurance. If you have any pre-existing ailments or are at risk, make sure your coverage covers those as well.

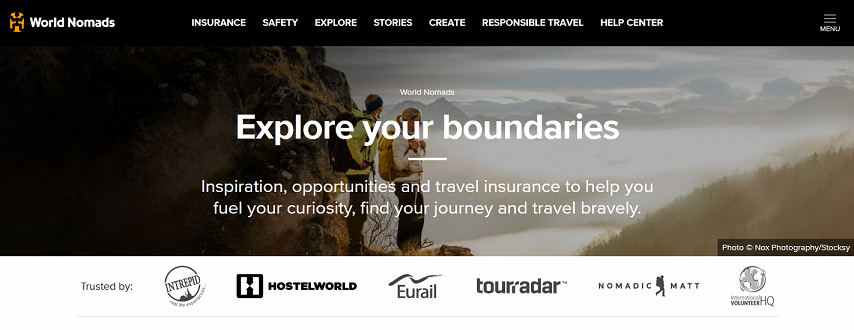

1. World Nomads

Terrorist attacks, assault, medical repatriation, equipment and baggage, and international medical and dental care are all covered. Snow sports, water sports, aviation, motorsports, athletics, and high-adventure events are all included in the Explorer Plan. More than 200 activities are included, many of which are expressly prohibited by other insurers.

For the Explorer Plan, a solitary 35-year-old would spend roughly $200 for a month in Thailand, depending on factors such as age and place of origin, which is fairly inexpensive for such comprehensive coverage. The lower-coverage Standard Plan costs roughly $100 for the same trip, but if you’re concerned about something going wrong, it makes sense to choose higher coverage levels.

This policy is insured in the United States by Nationwide (A+ rated by AM Best), and it includes a $100,000 maximum for emergency accidents and illnesses, a $500,000 limit for emergency evacuation, a $10,000 limit for trip cancellation (or interruption), and much more. While it does not have the same insurance reputation as some other providers, it does partner with very respectable organizations to underwrite policies and receives generally positive feedback.

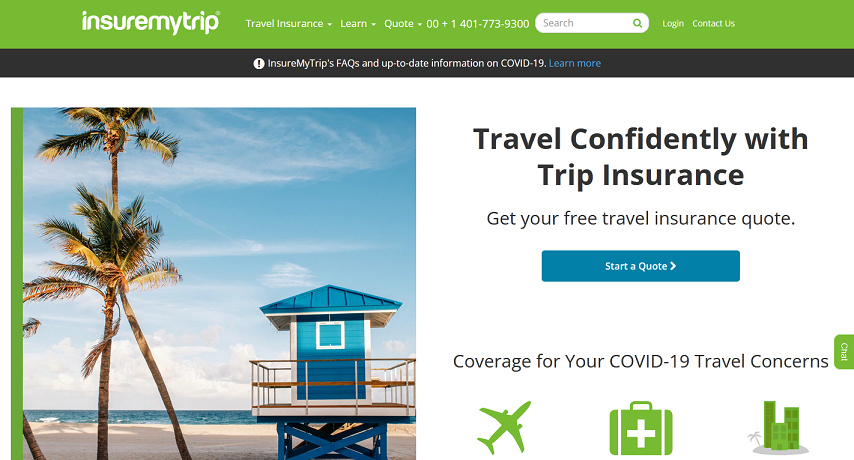

2. InsureMyTrip

A quote for a family of four taking a 14-day trip that costs $4,000 and includes aircraft and hotel expenditures yielded three proposed plans with prices ranging from roughly $100 to $400 for varied levels of protection. Luggage coverage, travel delay, and medical treatment were among the basic features. Rates will vary depending on where clients are coming from and where they are going on vacation, as well as other factors.

The insurers you’ll find on InsureMyTrip have received a range of industry ratings and are usually regarded as respectable and financially stable. However, just as with policies purchased directly from insurers, it’s a good idea to study the policy terms before pressing the buy button. Each underlying insurer has its own set of claims procedures, exclusions, and restrictions. However, InsureMyTrip makes it easier to make an informed travel insurance purchase.

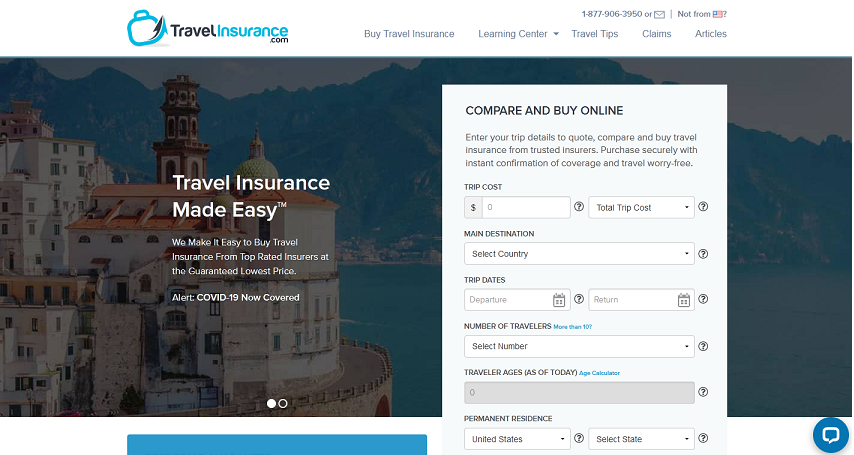

3. TravelInsurance.com

TravelInsurance.com collaborates with some of the country’s largest and best-rated insurers to make shopping for and purchasing travel insurance easier.

Because it is a travel insurance marketplace, when you enter the cost and duration of your trip, it will provide quotations from numerous travel insurance companies.

After giving this information, you will receive quotations from each company in a way that allows you to easily compare pricing, weigh advantages and downsides, and locate special coverages.

4. Travelex Insurance Services

The Travel Select plan starts at $28 and covers trip cancellation, trip interruption, emergency medical, and evacuation coverage, but there are various ways to personalize and increase coverage. For cancellations, travel is covered up to $25,000 in full. For trip disruptions, you can get up to 150 percent of the trip cost up to $37,500. Emergency medical coverage is limited to $50,000, while emergency evacuation coverage is limited to $500,000.

Furthermore, Travel Select provides a 15-day pre-existing condition exclusion waiver. Your pre-existing injury or disease is likely to be covered if you purchase your coverage within 15 days of paying for your trip and insure the full cost of the trip.

5. Nationwide Travel Insurance

Its custom-tailored cruise arrangements, on the other hand, are what landed it in this category. The Universal Cruise Plan, Choice Cruise Plan, and Luxury Cruise Plan make it simple to select the appropriate coverage for your specific needs. For example, a couple on a 10-day trip to Mexico was quoted a cost of roughly $200 for both the Universal and Choice plans.

Nationwide cruise insurance covers the things you’re most concerned about when going on a trip. Breakdowns on ships and itinerary modifications might result in missed excursions, flights, and other fees. Emergency medical expenses are covered up to $75,000 under the Universal Cruise plan, with medical evacuation benefits up to $250,000. After witnessing numerous medical difficulties on cruise ships, it is prudent to protect your trip with insurance that is ready to assist you.

Furthermore, all plans offer coverage for weather, school session extensions, job crises, and terrorism. The luxury plan also includes coverage for Centers for Disease Control and Prevention alerts at your destination.

6. Allianz Travel Insurance

For trip cancellation or interruption coverage, AllTrips Executive offers tiered limitations beginning at $5,000. They also provide $50,000 in emergency medical coverage and $250,000 in emergency transportation coverage per insured, each trip. There is a long list of exclusions, including extreme sports, so check the fine print before embarking on an excursion.

The price point for a single traveler, a couple, and a family of four was $500 per traveler per year. If you spend $120 per person per trip for comprehensive coverage, you’ll break even with this plan if you travel at least five times per year. If you want to save money, Allianz offers the AllTrips Basic, Premier, and Prime options.

7. HTH Worldwide Travel Insurance

Policies for travelers with existing primary insurance provide 100 percent coverage for normal hospital expenditures including as surgery, testing, office visits, inpatient hospital stays, and prescription prescriptions outside of the United States, among other things. Up to $500,000 in medical evacuation coverage is available, but trip interruption and baggage coverage are limited. Most people will choose this plan for its medical advantages rather than its travel features. Applicants must be 95 years old or younger to be eligible for this coverage.

Insurance is also accessible for those who do not currently have health care. Most seniors in the United States have some form of existing coverage, like as Medicare, but Medicare does not function outside of the United States, leaving seniors uninsured when traveling abroad. HTH Travel Insurance offers plans for customers who do not have previous medical coverage. The age limit is 74, although there is a pre-existing condition exclusion of 180 days.

8. GeoBlue Travel Insurance

GeoBlue is a wonderful option if you only need medical coverage. This insurer exclusively provides travel medical coverage. When you pay for medical coverage, you are not paying for the remainder of your travel insurance, which may already be covered. If you already have a credit card with travel insurance, for example, missing luggage and missed flights are most certainly covered by the rules of your card. Instead, you are just reimbursed for medical expenses, which can be as low as a few dollars each day.

You’ll spend a lot less than most other insurers on this list because you’re basically getting travel medical coverage. Just be sure you understand exactly what is and isn’t covered. With GeoBlue’s policies, you will only receive limited luggage protection and travel interruption coverage.

GeoBlue offers two general options for single trips, multiple excursions, and long-term travel. There are also five specialist policies for specific travel medical insurance needs, such as study abroad. It does not cover everything linked to your trip, but it significantly reduces the cost of medical coverage.